Selecting the right sales system can significantly impact your business’s success. Cash registers offer basic transaction handling, but they lack the advanced features modern businesses demand. In contrast, POS systems provide enhanced functionality, scalability, and cost-effectiveness. For example, the global POS software market is projected to grow from $18.3 billion in 2022 to $74.7 billion by 2032, reflecting their rising demand. POS systems improve efficiency by reducing errors, tracking inventory in real time, and enabling faster checkouts. Trusted providers like DcaPOS ensure these solutions are tailored to meet your business needs.

Key Takeaways

- Cash registers work well for small businesses with simple sales needs.

- POS systems have features like tracking inventory and analyzing data.

- These features help growing businesses run better and serve customers faster.

- Think about your business type and payment methods before choosing.

- Cash registers are harder to expand, but POS systems grow with your business.

- DcaPOS offers flexible POS systems for different needs and budgets.

- Cash registers cost less upfront, but POS systems save money over time.

- Look at your business problems and future plans to pick the best system.

What is a Cash Register?

Definition and Overview

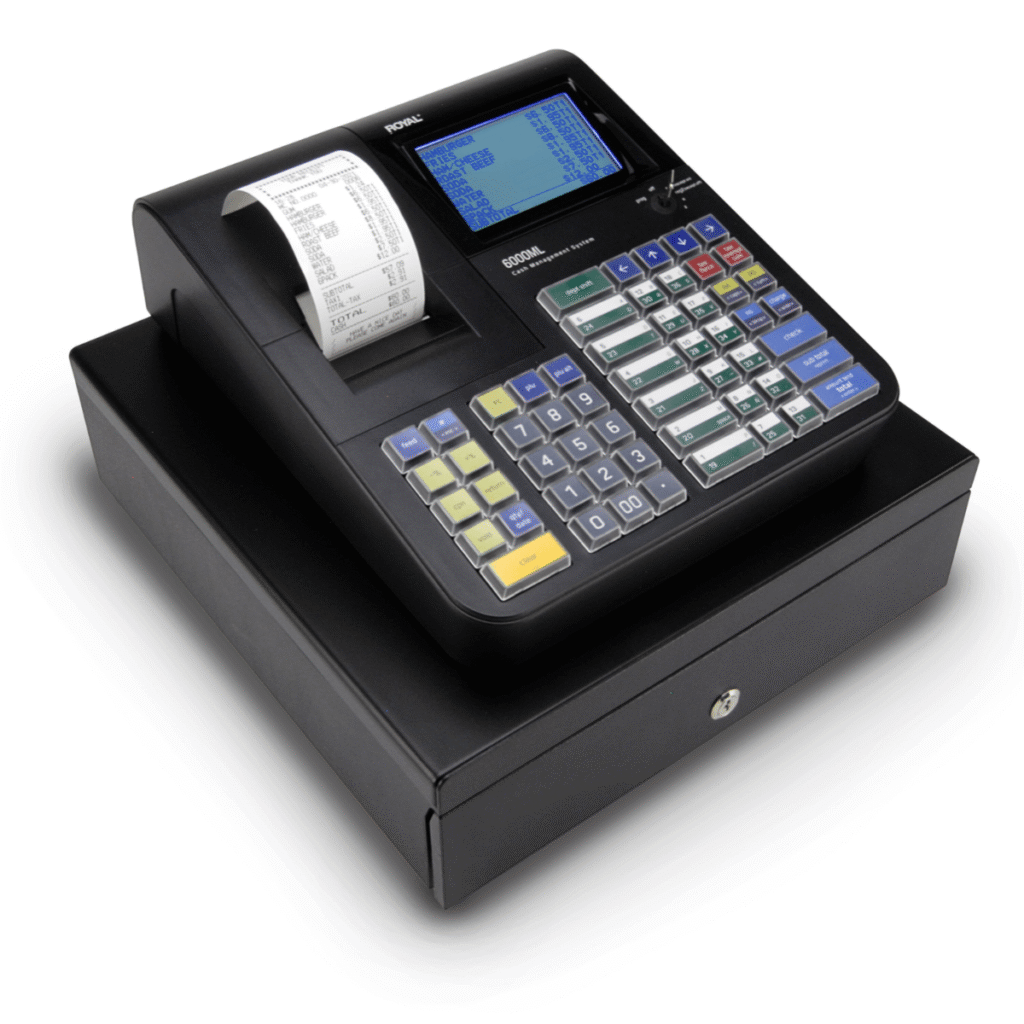

A cash register is a device designed to record sales transactions, calculate totals, and manage payments. It has been a cornerstone of retail operations since its invention in 1879 by James Ritty and John Birch. The original machine, called Ritty’s Incorruptible Cashier, aimed to prevent employee theft. In 1884, John H. Patterson revolutionized the cash register by adding a paper roll for recording sales, improving bookkeeping and fraud prevention.

Modern cash registers, often referred to as electronic cash registers (ECRs), have evolved significantly. They now include features like barcode scanners, receipt printers, and even inventory tracking systems. These advancements make cash registers essential for businesses that prioritize efficient transaction handling and financial management.

Tip: If your business requires a simple yet reliable solution for managing daily transactions, a cash register might be the right choice.

How Does a Cash Register Work?

Cash registers operate through a series of straightforward processes that streamline retail transactions:

- Transaction Processing: You scan items, enter prices, apply discounts, and calculate taxes.

- Payment Handling: The register accepts payments via cash, credit/debit cards, or mobile payment methods.

- Receipt Generation: It prints detailed receipts for customers, which are crucial for returns and exchanges.

- Cash Management: The cash drawer ensures that cash matches sales at the end of each shift.

- Sales Tracking: Reports on daily sales and popular items help you make informed business decisions.

- Inventory Management: Stock levels update automatically as items are sold.

- Customer Relationship Management: Purchase tracking enables targeted promotions.

- Security Features: Physical and digital security measures protect against fraud.

Modern cash registers integrate with inventory systems, providing real-time updates on stock levels. This feature helps businesses maintain optimal inventory and streamline reordering processes. Additionally, built-in sales tracking capabilities allow you to analyze customer behavior and sales trends effectively.

Key Features of Cash Registers

Cash registers offer a range of features that cater to the needs of retail businesses. Recent studies highlight the most utilized functionalities:

| Feature | Description |

|---|---|

| Cloud Connectivity | Enables remote data access and management, enhancing operational flexibility. |

| Robust Security Features | Protects transactions, ensuring customer data safety and trust. |

| Compatibility with Payment Methods | Supports various payment options, catering to diverse customer preferences. |

| Integration with Inventory Management | Streamlines stock tracking and management, improving efficiency. |

| Multi-Screen Systems | Enhances user experience and operational efficiency through better interface design. |

| Mobile POS Solutions | Facilitates transactions on-the-go, improving customer service and convenience. |

Other notable features include real-time sales tracking, loyalty program integration, and omnichannel retailing support. These capabilities make cash registers versatile tools for businesses seeking reliable transaction management.

Pros and Cons of Cash Registers

When deciding whether a cash register suits your business, understanding its advantages and limitations is crucial. While cash registers remain a staple in many retail environments, they may not meet the demands of modern businesses.

Pros of Cash Registers

- Ease of Use

Cash registers are straightforward to operate. Their simple interface allows employees to process transactions quickly, minimizing training time. This makes them ideal for small businesses with limited resources. - Affordability

Compared to advanced systems, cash registers have lower upfront costs. You can purchase a reliable model without straining your budget, making it a cost-effective choice for startups or businesses with tight margins. - Durability

Many cash registers are built to last. Their robust design ensures they can withstand heavy daily use, reducing the need for frequent replacements. - Basic Inventory Tracking

Some modern cash registers include inventory tracking features. These help you monitor stock levels and avoid overstocking or running out of popular items.

Tip: If your business focuses on simple transactions and operates in a low-tech environment, a cash register might be the perfect fit.

Cons of Cash Registers

- Limited Functionality

Cash registers lack advanced features like detailed sales analytics, customer relationship management, and multi-location inventory tracking. This limits their ability to support business growth. - Scalability Challenges

As your business expands, cash registers may struggle to keep up. They are not designed to handle complex operations or integrate with other systems, which can hinder scalability. - Manual Processes

Many tasks, such as generating detailed reports or managing loyalty programs, require manual effort. This increases the risk of errors and consumes valuable time. - Restricted Payment Options

While some cash registers accept credit cards, they often lack support for modern payment methods like mobile wallets or contactless payments. This can frustrate tech-savvy customers.

| Aspect | Cash Register |

|---|---|

| Functionality | Basic transaction handling; lacks advanced features. |

| Scalability | Suitable for small businesses; struggles with growth. |

| Payment Options | Limited support for modern payment methods. |

| Integration | Minimal compatibility with other systems. |

Understanding these pros and cons will help you evaluate whether a cash register aligns with your business needs. While it offers simplicity and affordability, its limitations may restrict your ability to adapt to evolving market demands.

What is a POS System?

Definition and Overview

A Point of Sale (POS) system is a modern solution that goes beyond basic transaction handling. It serves as a comprehensive tool for managing sales, inventory, customer relationships, and more. Unlike traditional cash registers, POS systems integrate advanced software and hardware to streamline operations and improve efficiency.

The evolution of POS technology highlights its growing importance in the business world. From the mechanical cash registers of the 19th century to today’s cloud-based and AI-driven systems, POS systems have transformed how businesses operate. For instance, the introduction of mobile POS (mPOS) systems has enabled businesses to process transactions anywhere, offering unparalleled flexibility. Additionally, cloud computing has made it possible to access real-time data remotely, reducing costs and enhancing decision-making.

Note: Modern POS systems are not just tools for processing payments. They are strategic assets that help you manage your business more effectively.

How Does a POS System Work?

A POS system operates through a combination of hardware and software, ensuring seamless transactions and efficient management. Here’s how it works:

- Transaction Workflow: The process begins when you select a product or service. The system calculates the total cost, including taxes and discounts.

- Payment Processing: It supports multiple payment methods, such as credit cards, mobile wallets, and contactless payments, ensuring convenience for your customers.

- Authorization: The system verifies payment details and updates the transaction status in real time.

- System Integration: POS systems integrate with inventory management, CRM, and accounting tools, creating a cohesive operational framework.

- Data Handling: They securely capture, store, and synchronize data across platforms, enabling accurate reporting and analytics.

- Security Practices: Advanced encryption and tokenization protect sensitive customer information, ensuring compliance with industry standards.

These processes make POS systems indispensable for businesses aiming to enhance operational efficiency and customer satisfaction. For example, 59% of restaurants prioritize technology that improves the customer experience, and POS systems play a crucial role in achieving this goal.

Key Features of POS Systems

Modern POS systems offer a wide range of features designed to meet the needs of diverse businesses. Here are some of the most impactful functionalities:

| Feature | Description |

|---|---|

| Product Catalogs | Simplifies product discovery, increasing conversion rates by up to 25%. |

| Customer Information | Tracks customer habits, enabling personalized promotions and better inventory management. |

| Gift Cards and Promotions | Integrates discounts and special offers directly into the checkout process, enhancing customer satisfaction. |

| Omnichannel Checkout | Reduces checkout times by up to 30%, improving the shopping experience for customers who use multiple channels. |

| Loyalty Programs | Encourages repeat business by offering accurate rewards and simplifying the redemption process. |

| Detailed Analytics | Provides actionable insights into sales performance, helping you make data-driven decisions. |

| Returns and Exchanges | Streamlines the return process, reducing return times by up to 80% and improving customer satisfaction. |

| Cloud-Based Accessibility | Offers secure, remote access to data, allowing you to manage your business from anywhere. |

These features demonstrate why 52% of restaurants plan to upgrade or implement POS systems by 2025. The integration of AI and machine learning further enhances their capabilities, enabling data-driven decision-making and personalized customer experiences.

Tip: Investing in a POS system can help you stay ahead of technological trends and meet the evolving expectations of your customers.

Pros and Cons of POS Systems

POS systems offer a wide range of benefits, but they also come with certain limitations. Understanding these aspects will help you decide if a POS system aligns with your business goals.

Pros of POS Systems

- Enhanced Efficiency

POS systems streamline checkout processes. Scanning an item takes only 0.3 seconds, compared to six seconds for manual input on a cash register. This speed reduces wait times and improves customer satisfaction. - Accurate Data Management

Barcode scanning minimizes errors, with a mistake rate of just one error per 15,000 to 36 trillion characters scanned. This accuracy ensures reliable inventory tracking and sales reporting. - Advanced Features

POS systems provide tools like automated inventory management, detailed sales analytics, and customer relationship management (CRM). These features help you make data-driven decisions and improve operational efficiency. - Integration Capabilities

Unlike cash registers, POS systems integrate seamlessly with other business tools, such as accounting software and e-commerce platforms. This connectivity creates a unified system for managing your operations. - Long-Term Value

While the initial cost may be higher, POS systems offer continuous updates and new features. This adaptability ensures they remain valuable as your business grows.

Cons of POS Systems

- Higher Upfront Costs

The initial investment for a POS system can be significant. Hardware, software, and installation expenses may strain the budget of small businesses. - Ongoing Maintenance

POS systems require regular updates and technical support. These ongoing costs can add up over time, especially for businesses with limited resources. - Learning Curve

Employees may need training to use a POS system effectively. While modern interfaces are user-friendly, the transition from a cash register can take time. - Dependence on Technology

POS systems rely on stable internet connections and power supplies. Any disruption can temporarily halt operations, which may frustrate customers.

| Feature | Cash Register | POS System |

|---|---|---|

| Cost | Lower upfront cost | Higher upfront cost, long-term savings |

| Integration | No system integration | Seamless integration with other tools |

| Inventory Tracking | Manual tracking | Automated inventory management |

| Sales Analytics | Limited tracking | Advanced analytics and reporting |

| Checkout Efficiency | Slower, manual input | Faster, barcode scanning |

| User-Friendliness | Basic interface | Intuitive touchscreen interface |

| Maintenance | Minimal maintenance | Regular updates and support required |

| Long-Term Value | Static features | Continuous feature updates |

Tip: If you prioritize efficiency, accuracy, and scalability, a POS system is a worthwhile investment despite its higher initial cost.

Why Choose a POS System from DcaPOS?

DcaPOS stands out as a trusted provider of modern POS solutions. Here’s why you should consider their systems for your business:

- Tailored Solutions

DcaPOS customizes its systems to meet your specific needs. Whether you run a small retail store or a multi-location business, their solutions adapt to your requirements.- Cutting-Edge Technology

DcaPOS integrates the latest advancements, including cloud-based accessibility and AI-driven analytics. These features enhance decision-making and operational efficiency.- Reliable Support

With DcaPOS, you gain access to 24/7 customer support. Their team ensures your system runs smoothly, minimizing downtime and disruptions.- Cost-Effective Options

DcaPOS offers scalable pricing plans, making advanced POS systems accessible to businesses of all sizes. Their solutions provide long-term value, helping you save money over time.Note: Choosing DcaPOS means investing in a partner committed to your success. Their expertise and innovative technology empower you to stay ahead in a competitive market.

Key Differences Between Cash Registers and POS Systems

Transaction Handling

Transaction handling is a critical aspect of any sales system. Cash registers focus on basic transaction processing, such as recording sales and calculating totals. They are straightforward to use, making them ideal for businesses with simple needs. However, they lack the flexibility and speed offered by POS systems.

POS systems excel in transaction handling by integrating advanced technologies. They support multiple payment methods, including contactless cards, mobile payments, and traditional credit cards. This versatility ensures faster checkouts and a better customer experience. For example, contactless card payments processed offline are 12.3 seconds faster than traditional card payments, while mobile payments outperform both in speed.

| Payment Method | Average Transaction Time | Time Difference Compared to Cash |

|---|---|---|

| Cash | Shortest | N/A |

| Traditional Card | 50% longer | +20 seconds |

| Contactless Card (Online) | Similar to Cash | N/A |

| Contactless Card (Offline) | 12.3 seconds shorter | -12.3 seconds |

| Mobile Payment | Faster than Cards | N/A |

POS systems also streamline transaction workflows by automating processes like tax calculations and discount applications. This reduces errors and improves efficiency, making them indispensable for businesses aiming to enhance operational performance.

Inventory Management

Inventory management is another area where cash registers and POS systems differ significantly. Cash registers offer basic inventory tracking, allowing you to monitor stock levels manually. While this feature is sufficient for small businesses, it becomes cumbersome as your inventory grows.

POS systems, on the other hand, provide automated inventory management. They update stock levels in real time as items are sold, ensuring accuracy and reducing the risk of overstocking or stockouts. Advanced POS systems even integrate with supply chain tools, enabling seamless reordering and forecasting.

For example, cloud-based POS systems allow you to access inventory data remotely, giving you the flexibility to manage stock across multiple locations. This scalability makes POS systems ideal for businesses with complex inventory needs. Additionally, detailed analytics offered by POS systems help you identify trends, optimize stock levels, and improve profitability.

Payment Options

Payment options play a vital role in customer satisfaction. Cash registers typically support basic payment methods, such as cash and traditional credit cards. While some modern cash registers accept mobile payments, their compatibility with newer technologies remains limited.

POS systems provide a broader range of payment options, including contactless cards, mobile wallets, and even cryptocurrency. This adaptability caters to diverse customer preferences and ensures a seamless checkout experience. For instance, POS systems can process mobile payments faster than traditional card transactions, reducing wait times and enhancing convenience.

Moreover, POS systems integrate payment processing with other features, such as loyalty programs and promotions. This creates a cohesive shopping experience that encourages repeat business. The ability to handle multiple payment methods efficiently makes POS systems a superior choice for businesses aiming to stay ahead of technological trends.

Reporting and Analytics

Effective reporting and analytics are essential for making informed business decisions. Cash registers and POS systems differ significantly in this area, with POS systems offering a clear advantage.

Cash registers provide basic reporting capabilities. You can generate daily sales summaries and track cash flow. However, these reports often lack depth and require manual effort to analyze trends or identify patterns. For instance, if you want to understand which products perform best during specific seasons, a cash register may not provide the necessary data.

POS systems, on the other hand, excel in reporting and analytics. They offer detailed insights into sales performance, customer behavior, and inventory trends. With a POS system, you can access real-time data and generate customized reports. For example, you can analyze which products sell best during weekends or identify your most loyal customers. These insights help you make data-driven decisions that improve profitability and customer satisfaction.

Tip: Use the advanced analytics features of a POS system to identify underperforming products and adjust your inventory strategy accordingly.

| Feature | Cash Register | POS System |

|---|---|---|

| Reporting Depth | Basic daily summaries | Detailed, customizable reports |

| Real-Time Data | Not available | Available |

| Trend Analysis | Manual effort required | Automated and accurate |

| Decision Support | Limited | Comprehensive |

By leveraging the robust analytics of a POS system, you can stay ahead of market trends and optimize your operations.

Scalability

Scalability is a critical factor when choosing between a cash register and a POS system. As your business grows, your sales system must adapt to handle increased demands.

Cash registers are suitable for small businesses with limited needs. They perform well in single-location setups with straightforward operations. However, they struggle to scale. Adding new locations or managing a larger inventory often requires significant manual effort. For example, if you open a second store, you may need to purchase additional cash registers and manage each location separately.

POS systems are designed with scalability in mind. They can handle multi-location operations seamlessly. Cloud-based POS systems allow you to manage inventory, sales, and customer data across all your locations from a single dashboard. This centralized control simplifies operations and reduces administrative overhead. Additionally, POS systems can integrate with other tools, such as e-commerce platforms, enabling you to expand into online sales effortlessly.

Note: If you plan to grow your business, investing in a scalable POS system will save you time and resources in the long run.

| Aspect | Cash Register | POS System |

|---|---|---|

| Multi-Location Support | Limited | Seamless |

| Inventory Management | Manual | Centralized and automated |

| Integration Capabilities | Minimal | Extensive |

| Growth Potential | Restricted | High |

Choosing a scalable POS system ensures your business can adapt to future growth without operational disruptions.

Costs

Cost is often a deciding factor when selecting a sales system. Understanding the short-term and long-term expenses of cash registers and POS systems will help you make an informed choice.

Cash registers have a lower upfront cost. You can purchase a basic model for a few hundred dollars, making them an affordable option for startups or small businesses. Maintenance costs are minimal, and the system requires little to no updates. However, the lack of advanced features may lead to hidden costs. For example, manual inventory tracking and reporting can consume valuable time and resources.

POS systems involve higher initial costs. You need to invest in hardware, software, and installation. However, they offer long-term value through increased efficiency and advanced features. Many providers, like DcaPOS, offer flexible pricing plans to make these systems accessible. Additionally, cloud-based POS systems reduce maintenance costs by eliminating the need for on-site servers.

Alert: While cash registers may seem cost-effective initially, their limitations can result in higher operational costs over time.

| Cost Aspect | Cash Register | POS System |

|---|---|---|

| Initial Investment | Low | High |

| Maintenance Costs | Minimal | Moderate |

| Long-Term Value | Limited | High |

| Hidden Costs | Manual processes | None |

When evaluating costs, consider the long-term benefits of a POS system. Its ability to streamline operations and support growth often outweighs the higher upfront investment.

Pros and Cons of Each Option

Advantages of Cash Registers

Cash registers offer several benefits that make them a practical choice for certain businesses.

- Cost-Effective Solution

A cash register is an affordable option for small businesses or startups. Its low upfront cost allows you to manage transactions without a significant financial burden. - Ease of Use

Operating a cash register requires minimal training. Its straightforward interface ensures your employees can quickly learn to process sales, reducing onboarding time. - Durability

Many cash registers are built to withstand heavy use. Their robust design ensures they remain functional even in high-traffic environments, minimizing the need for frequent repairs or replacements. - Basic Inventory Tracking

Some modern cash registers include basic inventory management features. These tools help you monitor stock levels and avoid running out of essential items.

Tip: If your business focuses on simple transactions and operates in a single location, a cash register might be the ideal choice.

Disadvantages of Cash Registers

While cash registers have their advantages, they also come with limitations that may hinder your business’s growth.

- Limited Functionality

Cash registers lack advanced features like detailed analytics, customer relationship management, and multi-location inventory tracking. This restricts their ability to support complex operations. - Scalability Issues

Expanding your business with a cash register can be challenging. Managing multiple locations or a growing inventory often requires additional manual effort, which can slow down operations. - Restricted Payment Options

Most cash registers only support basic payment methods, such as cash and traditional credit cards. They may not accommodate modern payment technologies like mobile wallets or contactless payments, which could frustrate tech-savvy customers. - Manual Processes

Tasks like generating detailed reports or managing loyalty programs often require manual input. This increases the risk of errors and consumes valuable time that could be spent on other business activities.

| Aspect | Cash Register |

|---|---|

| Functionality | Basic transaction handling; lacks advanced features. |

| Scalability | Suitable for small businesses; struggles with growth. |

| Payment Options | Limited support for modern payment methods. |

| Integration | Minimal compatibility with other systems. |

Advantages of POS Systems

POS systems provide a wide range of benefits that can transform how you manage your business.

- Enhanced Efficiency

POS systems streamline checkout processes, reducing wait times for customers. Features like barcode scanning and automated tax calculations ensure faster and more accurate transactions. - Comprehensive Data Management

With a POS system, you can track sales, inventory, and customer behavior in real time. This data helps you make informed decisions and identify opportunities for growth. - Advanced Features

POS systems offer tools like loyalty programs, detailed analytics, and multi-location management. These features enable you to enhance customer satisfaction and optimize operations. - Integration Capabilities

Unlike cash registers, POS systems integrate seamlessly with other business tools, such as accounting software and e-commerce platforms. This connectivity creates a unified system for managing your operations. - Scalability

As your business grows, a POS system can adapt to meet your needs. Whether you add new locations or expand your product offerings, a POS system ensures smooth operations without additional manual effort.

Note: Investing in a POS system allows you to stay competitive by leveraging advanced technology and improving customer experiences.

Disadvantages of POS Systems

While POS systems offer numerous advantages, they also come with certain drawbacks that you should consider before making an investment.

- Higher Initial Costs

POS systems require a significant upfront investment. You need to purchase hardware like touchscreens, barcode scanners, and receipt printers. Additionally, software licensing fees and installation costs can add to the expense. For small businesses with limited budgets, this initial cost may feel overwhelming.Tip: Look for providers like DcaPOS that offer flexible pricing plans to ease the financial burden. - Ongoing Maintenance and Updates

Unlike cash registers, POS systems demand regular maintenance. Software updates are essential to keep the system secure and functional. You may also need technical support to resolve issues, which can incur additional costs. These ongoing expenses can strain your budget if not planned properly. - Learning Curve for Employees

Training your staff to use a POS system effectively takes time. While modern systems are user-friendly, the transition from a cash register can still be challenging. Employees may initially struggle with advanced features like inventory management or analytics. This learning curve could temporarily slow down operations. - Dependence on Technology

POS systems rely heavily on technology. A stable internet connection and consistent power supply are crucial for their operation. Any disruption, such as a network outage, can halt transactions and frustrate customers. This dependence on external factors makes POS systems less reliable in certain situations.Alert: Always have a backup plan, like a manual payment process, to avoid downtime during technical issues. - Security Concerns

While POS systems include advanced security features, they are not immune to cyber threats. Hackers may target your system to steal sensitive customer data. You must invest in robust cybersecurity measures to protect your business, which adds to the overall cost.

| Aspect | Challenge |

|---|---|

| Initial Costs | High upfront investment for hardware and software. |

| Maintenance | Regular updates and technical support required. |

| Employee Training | Time-consuming learning process for advanced features. |

| Technology Dependence | Vulnerable to internet or power outages. |

| Security | Risk of cyberattacks; requires additional investment in cybersecurity. |

Understanding these disadvantages will help you weigh the pros and cons of a POS system. While the benefits often outweigh the drawbacks, careful planning and preparation are essential to maximize your investment.

Cost Comparison

Initial Setup Costs

When evaluating the initial setup costs, cash registers often appear more budget-friendly. You can purchase a basic cash register for as little as $200 to $500. This makes them an attractive option for startups or small businesses with limited capital. The simplicity of cash registers means you won’t need to invest in additional hardware or software, keeping upfront expenses low.

POS systems, however, require a more substantial investment. A modern POS system typically costs between $1,000 and $5,000, depending on the features and hardware you choose. This includes touchscreen monitors, barcode scanners, receipt printers, and software licenses. If you opt for cloud-based POS solutions, subscription fees may also apply. While the initial cost is higher, the advanced functionality of POS systems often justifies the expense.

Tip: If your business prioritizes affordability and simplicity, a cash register may be the better choice. However, if you aim to scale and streamline operations, investing in a POS system offers greater long-term benefits.

| Aspect | Cash Register | POS System |

|---|---|---|

| Upfront Cost | $200–$500 | $1,000–$5,000 |

| Hardware Requirements | Minimal | Extensive |

| Software Costs | None | Subscription fees may apply |

Ongoing Maintenance Costs

Cash registers have minimal maintenance requirements. Once installed, they rarely need updates or technical support. Repairs are straightforward and inexpensive, often involving physical components like buttons or cash drawers. This simplicity keeps ongoing costs low, making cash registers a reliable option for businesses with tight budgets.

POS systems, on the other hand, demand regular maintenance. Software updates are essential to ensure security and functionality. You may also need technical support to troubleshoot issues or integrate new features. These services often come with additional fees. If your POS system relies on cloud-based technology, you’ll need to factor in monthly subscription costs. While these expenses can add up, they ensure your system remains efficient and up-to-date.

Alert: Consider the long-term implications of maintenance costs. While cash registers are cheaper to maintain, their limited functionality may lead to inefficiencies that cost you more in the long run.

| Maintenance Aspect | Cash Register | POS System |

|---|---|---|

| Updates | Rarely needed | Regular software updates required |

| Technical Support | Minimal | Essential for troubleshooting |

| Subscription Fees | None | Monthly fees for cloud-based systems |

Long-Term Value

The long-term value of a sales system depends on its ability to adapt to your business needs. Cash registers offer durability and simplicity, but their static features limit their usefulness as your business grows. Over time, manual processes like inventory tracking and reporting can become costly in terms of time and labor.

POS systems provide superior long-term value. Their advanced features, such as automated inventory management and detailed analytics, save time and reduce errors. Integration capabilities allow you to expand into e-commerce or multi-location operations seamlessly. While the upfront and maintenance costs are higher, the efficiency and scalability of POS systems often result in significant savings over time.

Note: Investing in a POS system is like planting a seed for future growth. Its adaptability ensures your business can thrive in a competitive market.

| Aspect | Cash Register | POS System |

|---|---|---|

| Scalability | Limited | High |

| Efficiency | Manual processes | Automated and streamlined |

| Long-Term Savings | Minimal | Significant |

Cost-Effective Solutions from DcaPOS

When it comes to balancing affordability and functionality, DcaPOS stands out as a leader in providing cost-effective POS solutions. Whether you run a small business or manage multiple locations, DcaPOS offers tailored systems that deliver exceptional value without breaking your budget.

1. Flexible Pricing Plans

DcaPOS understands that every business has unique financial constraints. To address this, they offer a variety of pricing plans designed to fit businesses of all sizes. You can choose from:

- Subscription-Based Plans: Pay a manageable monthly fee for access to advanced features and regular updates.

- One-Time Purchase Options: Invest upfront in a system that provides long-term value without recurring costs.

Tip: If you’re unsure which plan suits your needs, DcaPOS provides consultations to help you make an informed decision.

2. Scalable Solutions

As your business grows, your POS system should grow with it. DcaPOS systems are designed to scale effortlessly. You can add new features, integrate additional hardware, or expand to multiple locations without replacing your existing setup. This scalability ensures you only pay for what you need, when you need it.

3. Reduced Maintenance Costs

DcaPOS systems are built with reliability in mind. Their cloud-based solutions eliminate the need for costly on-site servers, reducing maintenance expenses. Additionally, their systems receive automatic updates, ensuring you always have access to the latest features without extra charges.

4. Enhanced Efficiency Saves Money

By automating tasks like inventory management, sales tracking, and reporting, DcaPOS systems save you time and reduce labor costs. For example, automated inventory updates minimize errors and prevent overstocking, which can lead to significant savings over time.

| Feature | Benefit |

|---|---|

| Cloud-Based Technology | Eliminates server costs and ensures seamless updates. |

| Automated Inventory | Reduces errors and optimizes stock levels. |

| Scalable Features | Allows you to expand without replacing the system. |

5. Long-Term Value

Investing in a DcaPOS system is a smart financial decision. While the initial cost may be higher than a traditional cash register, the long-term savings and increased efficiency make it a cost-effective choice. You’ll benefit from advanced features that streamline operations and improve customer satisfaction, ensuring a strong return on investment.

Note: Choosing DcaPOS means partnering with a provider committed to your success. Their affordable, scalable, and efficient solutions empower you to focus on growing your business.

Which One is Right for Your Business?

Factors to Consider

Choosing between a cash register and a POS system depends on several factors unique to your business. To make the right decision, you need to evaluate your current operations and anticipate future needs. Here are key considerations to guide your choice:

- Business Type: Retail businesses often benefit from POS systems due to their advanced inventory management and customer tracking features. Experience-based businesses, such as salons or gyms, may prioritize appointment scheduling and loyalty programs, which POS systems can offer.

- Payment Methods: If your customers prefer diverse payment options like digital wallets or contactless cards, a POS system ensures compatibility. A cash register may suffice if cash and traditional card payments dominate your transactions.

- Operational Efficiency: Features like inventory management, employee tracking, and customer information storage streamline operations. POS systems excel in these areas, enhancing productivity and reducing manual tasks.

- Security: PCI compliance and robust security measures are critical for protecting customer data. POS systems typically offer advanced encryption and fraud prevention tools, making them a safer choice for businesses handling sensitive information.

- Scalability: If you plan to expand your business, a POS system provides the flexibility to manage multiple locations and integrate with e-commerce platforms. Cash registers may struggle to adapt to growth.

Tip: Assess your business goals and operational challenges before deciding. A clear understanding of your needs ensures you invest in the right solution.

Scenarios Where a Cash Register is Better

A cash register remains a practical choice for businesses with straightforward needs. Here are scenarios where it might be the better option:

- Small Businesses with Limited Budgets

If your business operates on a tight budget, a cash register offers an affordable solution. Its low upfront cost allows you to manage transactions without significant financial strain. - Single-Location Operations

Businesses with one physical location and simple inventory requirements can benefit from the simplicity of a cash register. It handles basic transaction processing efficiently without the need for advanced features. - Low-Tech Environments

If your business operates in an area with unreliable internet access or limited technological infrastructure, a cash register provides a dependable alternative. It functions independently of external systems, ensuring uninterrupted operations. - Minimal Payment Options

If your customers primarily pay with cash or traditional credit cards, a cash register meets your needs without the complexity of modern payment integrations.

| Scenario | Why a Cash Register Works |

|---|---|

| Small Budget | Affordable upfront cost. |

| Single Location | Simple transaction handling. |

| Low-Tech Environment | Operates without internet dependency. |

| Limited Payment Methods | Supports basic payment options. |

Note: A cash register is ideal for businesses that prioritize simplicity and affordability over advanced functionality.

Scenarios Where a POS System is Better

POS systems shine in environments that demand efficiency, scalability, and advanced features. Consider these scenarios where a POS system is the optimal choice:

- Growing Businesses

If your business is expanding, a POS system adapts to your needs. It supports multi-location operations, centralized inventory management, and seamless integration with e-commerce platforms. - Diverse Payment Preferences

For businesses catering to tech-savvy customers, a POS system accommodates modern payment methods like mobile wallets, contactless cards, and even cryptocurrency. This flexibility enhances customer satisfaction. - Data-Driven Decision Making

POS systems provide detailed analytics and reporting tools. These features help you track sales trends, monitor inventory, and understand customer behavior, enabling informed decisions that drive growth. - Complex Inventory Needs

Businesses with large or diverse inventories benefit from automated stock tracking and reordering features. A POS system ensures accuracy and reduces the risk of stockouts or overstocking. - Enhanced Customer Experience

Features like loyalty programs, personalized promotions, and faster checkouts improve customer satisfaction. POS systems streamline these processes, creating a seamless shopping experience.

| Scenario | Why a POS System Works |

|---|---|

| Business Growth | Scalable features for multi-location operations. |

| Diverse Payment Options | Supports modern payment methods. |

| Data Analytics | Provides actionable insights for decision-making. |

| Complex Inventory | Automates stock tracking and reordering. |

| Customer Experience | Enhances satisfaction through loyalty programs and faster checkouts. |

Alert: Investing in a POS system ensures your business stays competitive in a rapidly evolving market.

How DcaPOS Can Help Your Business

DcaPOS offers solutions that empower your business to operate efficiently and scale seamlessly. Whether you manage a small retail store or a multi-location enterprise, DcaPOS provides tools tailored to your needs. Here’s how DcaPOS can transform your operations:

1. Customizable Features for Your Business Needs

DcaPOS systems adapt to your unique requirements. You can select features that align with your goals, whether you need advanced inventory tracking, customer relationship management, or multi-location support. This flexibility ensures you only pay for the tools you use.

Tip: If your business evolves, DcaPOS allows you to upgrade your system without replacing existing hardware.

2. Streamlined Operations for Maximum Efficiency

DcaPOS automates time-consuming tasks like inventory updates, sales tracking, and reporting. These features reduce errors and free up your time for strategic planning. For example, automated inventory management ensures stock levels remain accurate, preventing costly overstocking or stockouts.

- Key Benefits:

- Faster checkout processes with barcode scanning.

- Real-time inventory updates across multiple locations.

- Automated reporting for actionable insights.

3. Advanced Analytics for Data-Driven Decisions

DcaPOS systems provide detailed analytics that help you understand customer behavior, sales trends, and inventory performance. You can use this data to optimize your operations and improve profitability.

| Analytics Feature | Benefit |

|---|---|

| Sales Performance Tracking | Identifies top-selling products and peak sales periods. |

| Customer Insights | Helps you create personalized promotions and loyalty programs. |

| Inventory Forecasting | Predicts demand to avoid stockouts or excess inventory. |

Note: With DcaPOS, you gain access to real-time data that supports smarter decision-making.

4. Seamless Integration with Other Tools

DcaPOS integrates with popular accounting software, e-commerce platforms, and CRM systems. This connectivity creates a unified framework for managing your business. You can track online and offline sales from one dashboard, simplifying operations.

Alert: Integration reduces manual data entry, saving time and minimizing errors.

5. Scalable Solutions for Growing Businesses

As your business expands, DcaPOS grows with you. You can add new locations, integrate additional hardware, or enhance features without disrupting your operations. Cloud-based accessibility ensures you can manage everything remotely.

- Scalability Features:

- Multi-location inventory management.

- Centralized reporting for all stores.

- Easy integration with new payment methods.

6. Reliable Support and Security

DcaPOS provides 24/7 customer support to ensure your system runs smoothly. Their advanced security measures protect sensitive customer data, giving you peace of mind.

Tip: DcaPOS systems comply with industry standards like PCI DSS, ensuring secure payment processing.

7. Cost-Effective Solutions for Long-Term Value

DcaPOS offers flexible pricing plans that fit businesses of all sizes. Subscription-based models allow you to access advanced features without a large upfront investment. Over time, the efficiency and scalability of DcaPOS systems save you money.

| Pricing Option | Benefit |

|---|---|

| Subscription-Based Plans | Affordable monthly fees with regular updates. |

| One-Time Purchase | Long-term value without recurring costs. |

Note: Investing in DcaPOS ensures your business stays competitive while managing costs effectively.

8. Enhanced Customer Experience

DcaPOS systems improve customer satisfaction through faster checkouts, personalized promotions, and loyalty programs. These features encourage repeat business and build stronger relationships with your customers.

Alert: A better customer experience leads to higher retention rates and increased revenue.

By choosing DcaPOS, you gain a partner dedicated to your success. Their innovative technology and reliable support empower you to focus on growing your business while staying ahead in a competitive market.

Choosing between a cash register and a POS system depends on your business needs. Cash registers offer simplicity and affordability, making them ideal for small operations. POS systems provide advanced features, scalability, and efficiency, which are essential for growing businesses. Aligning your choice with your goals ensures you maximize operational success.

Explore DcaPOS to find modern POS solutions tailored to your requirements. Their expertise and innovative technology empower you to streamline operations and enhance customer satisfaction.

FAQ

1. What is the main difference between a cash register and a POS system?

A cash register handles basic transactions, while a POS system offers advanced features like inventory management, analytics, and multi-location support. POS systems integrate with other tools, making them ideal for businesses seeking efficiency and scalability.

2. Can a POS system work without an internet connection?

Yes, many POS systems include offline modes. They store transaction data locally and sync it to the cloud once the connection restores. This ensures uninterrupted operations during temporary outages.

3. How much does a POS system cost compared to a cash register?

A cash register costs $200–$500 upfront, while a POS system ranges from $1,000–$5,000. POS systems offer long-term savings through automation and scalability, making them a better investment for growing businesses.

4. Are POS systems difficult to learn?

Modern POS systems feature intuitive interfaces, such as touchscreens and guided workflows. Training may take time, but most employees adapt quickly. Providers like DcaPOS offer support to simplify the learning process.

5. Can I use a POS system for multiple locations?

Yes, POS systems are designed for scalability. You can manage inventory, sales, and customer data across multiple locations from a single dashboard. This centralization streamlines operations and reduces administrative effort.

6. Do cash registers support modern payment methods?

Most cash registers handle cash and traditional credit cards. Some newer models accept mobile payments, but they lack the versatility of POS systems, which support contactless cards, digital wallets, and even cryptocurrency.

7. How does DcaPOS ensure data security?

DcaPOS uses advanced encryption and complies with PCI DSS standards. Their systems protect sensitive customer information and prevent fraud, ensuring your business operates securely.

8. Is a cash register suitable for a growing business?

Cash registers work well for small, single-location businesses. However, they struggle to scale. If you plan to expand or require advanced features, a POS system offers better adaptability and efficiency.